This article contains a quick overview of what needs to be run at month end. Also included is a detailed checklist of items that need to be done prior to running statements.

What to Run at Month End

- Process all sales, including EnergyTrack.

- Process all payments, including EnergyTrack.

- Enter and process Meter Readings if necessary (see Meter).

- Process Recurring Billing if applicable.

- Process Tank Rental if applicable.

- Run Age Analysis.

- Run Out of Balance Report and fix any outstanding issues.

- Print the Department Summary.

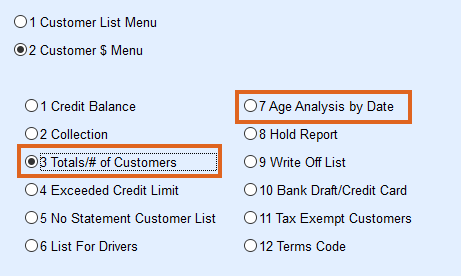

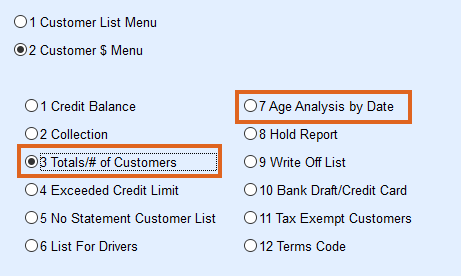

- Go to the Report Menu / Customer Reports.

- Choose 2 Customer $ Menu.

- Select 3 Totals/#of Customers and select Print.

- Choose 7 Age Analysis by Date and select Print.

- The totals on these two reports should match. If the reports match, proceed to Step 9. If they do not match, there may be an outstanding issue.

- Process Service Charges.

- Create a Statement File.

- Print Statements or send to Express Bill.

- Update Statements.

- Change the Posting Date.

Very Important: Change the Posting Date for a Division on the last day of the month or the Statement Date. This will stop anyone who wanted to void or make changes to a sale or payment in a previous month throwing off the A/R. This can be updated through the Supervisor Menu and should only be changed after closing out month end.

Month End Checklist

The month end checklist is a useful tool to help make sure you have completed all of the month end tasks. The list shown below is a sample and can be changed to better suit your companies needs.

|

|

Procedure |

Done |

|

1 |

Enter all manual sales tickets and payments for the month. |

|

|

2 |

Enter all meter readings for the month. |

|

|

3 |

Import temporary meter readings. |

|

|

4 |

Print the Meter PrePost report and review for errors. |

|

|

5 |

Make any necessary changes. |

|

|

6 |

Reprint the Meter PrePost report. |

|

|

7 |

Process the meter billings. |

|

|

8 |

Print the meter billing journal. |

|

|

9 |

Print meter invoices. |

|

|

10 |

Create a recurring billing file. |

|

|

11 |

Populate the recurring billing file. |

|

|

12 |

Print the recurring billing file and review for errors. |

|

|

13 |

Make any necessary changes. |

|

|

14 |

Reprint the recurring billing file. |

|

|

15 |

Post the recurring billing charges. |

|

|

16 |

Print the recurring billing journal. |

|

|

17 |

Create a tank rental file. |

|

|

18 |

Process the tank rental file. |

|

|

19 |

Print the Tank Rental report and review for errors. |

|

|

20 |

Make any necessary changes. |

|

|

21 |

Reprint the Tank Rental report. |

|

|

22 |

Update the tank rental charges. |

|

|

23 |

Print the Tank Rental Journal. |

|

|

24 |

Print Tank Rental Statements. |

|

|

25 |

Create the service charge file. |

|

|

26 |

Process service charges. |

|

|

27 |

Print the Service Charge report and review for errors. |

|

|

28 |

Make any necessary changes. |

|

|

29 |

Reprint the Service Charge report. |

|

|

30 |

Update the service charges. |

|

|

31 |

Run the Age Analysis Batch. |

|

|

32 |

Print the Out Of Balance report. If no accounts are out of balance, skip to Step 36. |

|

|

33 |

Correct any accounts that are out of balance. |

|

|

34 |

Run the Age Analysis Batch. |

|

|

35 |

Reprint the Out Of Balance report. |

|

|

36 |

Print the Age Analysis by Date report. |

|

|

37 |

Print the Department Summary report |

|

|

38 |

Balance accounts. |

|

|

39 |

Create a statement file. |

|

|

40 |

Process the statement data. |

|

|

41 |

Print statements or create the express bill file. |

|

|

42 |

Review statements for errors. |

|

|

43 |

Update the statement file. |

|

|

44 |

Create the bank draft file. |

|

|

45 |

Process the bank draft file. |

|

|

46 |

Print the bank draft exceptions. |

|

|

47 |

Print the bank draft file. |

|

|

48 |

Make any necessary changes. |

|

|

49 |

Reprint the bank draft file. |

|

|

50 |

Process the NACHA file. |

|

|

51 |

Update bank draft customers. |

|

|

52 |

Print the bank draft journal. |

|

|

53 |

Create the credit card file. |

|

|

54 |

Process the credit card file. |

|

|

55 |

Print credit card exceptions. |

|

|

56 |

Print the credit card file. |

|

|

57 |

Make any necessary changes. |

|

|

58 |

Reprint the credit card file. |

|

|

59 |

Update credit card customers. |

|

|

60 |

Print the credit card journal. |

|

|

61 |

Change the posting date. |

|

|

62 |

Print Department and Driver reports. |

|

|

63 |

Print Sales Tax reports. |

|

|

64 |

Print General Ledger reports. |

|